Nov 8, 2024

Nov 8, 2024

Nov 8, 2024

Product

Product

Product

Smooth sailing with smart case management

Khalil Osman

What is Case Management?

In the realm of trust and corporate service providers, case management refers to the structured handling of a series of interconnected tasks that may or may not require coordination across multiple teams. Case management is a critical method of bringing together people, processes, and documentation to ensure each step in a workflow is executed with accuracy and efficiency. Take, for example, the client onboarding process: this often involves various departments, such as client services, compliance, and finance, each contributing to specific steps that must be completed before onboarding is finalized.

Cases might start with document collection, proceed through identity verification, and include risk assessment, each stage involving different internal stakeholders. While case types vary based on organizational needs, they all share a common objective: ensuring a seamless, structured process that meets regulatory requirements and service standards. Because these processes are cross-departmental, trust and corporate service providers need a solid framework to keep every team aligned and prevent important tasks from slipping through the cracks.

The Role of Case Management for Trust and Corporate Service Providers

For trust and corporate service providers, case management is essential in several high-stakes areas where accuracy and auditability are paramount. Some of the most prominent examples include:

1. Client Onboarding and Entity Formation: Trust and corporate service providers are responsible for setting up new entities for clients, a process that involves stringent regulatory requirements and high standards for data accuracy. When forming an entity, trust and corporate service providers must verify the identities of all involved parties and ensure the characteristics of the entity aligns with jurisdictional requirements. This workflow involves multiple steps, from data collection to thorough verification, each one requiring input or approval from compliance or risk management teams. Case management becomes invaluable in tracking each task, maintaining records, and ensuring all requirements are met before moving forward.

2. Payment Processing and Monitoring: Once an entity is set up, trust and corporate service providers often process payments on behalf of clients, which introduces additional compliance needs. Payment processes are layered with various checks, particularly for large or high-risk transactions. For instance, a substantial transfer to a certain jurisdiction may trigger extra due diligence or security protocols. Effective case management helps trust and corporate service providers organize these multi-step checks, ensuring compliance requirements are met without excessive delay or risk of oversight.

3. Ongoing Monitoring and Compliance Checks: After onboarding, trust and corporate service providers must continually monitor client activities to detect any red flags or potential risks. This involves periodic reviews of client profiles, transaction patterns, and regulatory changes that may impact compliance. With case management, trust and corporate service providers can assign tasks, track progress, and ensure that each action is documented, creating an organized and reliable system for maintaining compliance over the long term. When a client’s profile is flagged, case management enables swift action by alerting relevant team members and allowing them to document and resolve issues efficiently.

The Patchwork of Tools: Challenges in Today’s Case Management

Many trust and corporate service providers still rely on an assortment of standalone tools to manage these complex workflows, creating a fragmented and often inefficient process. For example, one tool might handle client screening, another document uploads, and a third risk assessments, resulting in a disjointed user experience for both clients and teams. To help manage this patchwork of solutions, some organizations use task-tracking tools like Asana to manually monitor case progress, but such platforms lack compliance-specific capabilities and seamless integration across case management functions.

This fragmented approach not only slows down processes but also introduces risks, as critical steps can be missed, miscommunicated, or duplicated across systems. Furthermore, it’s challenging for team members to maintain a holistic view of each case when key details are scattered across different platforms. This siloed setup is inefficient and increases the risk of compliance lapses, which can be particularly costly or damaging in the trust and corporate service providers industry.

The Advantages of Integrated Case Management and Streamlined Workflows

Integrated case management platforms address these issues by bringing all necessary steps and stakeholders together within a single system. This centralization provides several important benefits for trust and corporate service providers:

1. Enhanced Visibility and Accountability: An integrated platform allows every team member to see the full scope of each case, including pending and completed tasks, responsibility assignments, and any outstanding requirements. This visibility not only keeps everyone on track but also ensures that any bottlenecks are quickly identified and resolved, helping cases progress efficiently.

2. Improved Cross-Departmental Collaboration: By having a unified platform, trust and corporate service providers can enable seamless teamwork across departments, as every team can access the same up-to-date information and easily communicate next steps or issues. This approach reduces time-consuming back-and-forths and fosters smooth collaboration, which is especially valuable for cases requiring multi-team involvement.

3. Time and Cost Savings: Integrated workflows eliminate the need for team members to constantly switch between platforms and hunt down information, allowing cases to move forward faster. This efficiency not only saves time but also reduces operational costs, as fewer resources are needed to manage each case.

4. Reduced Risk of Error: With all case details managed within a single platform, there’s a lower risk of oversight, duplication, or miscommunication. Every action can be tracked and documented in one place, ensuring all regulatory requirements are met and providing a reliable record for audits or investigations.

How Custos Excels in Case Management for trust and corporate service providers

Custos’s case management solution is purpose-built for trust and corporate service providers and other compliance-focused organizations, offering an intuitive platform where each step of a case can be managed from start to finish. With Custos, trust and corporate service providers can configure detailed workflows that cater to their unique process requirements, whether for onboarding new clients, processing payments, or conducting compliance reviews.

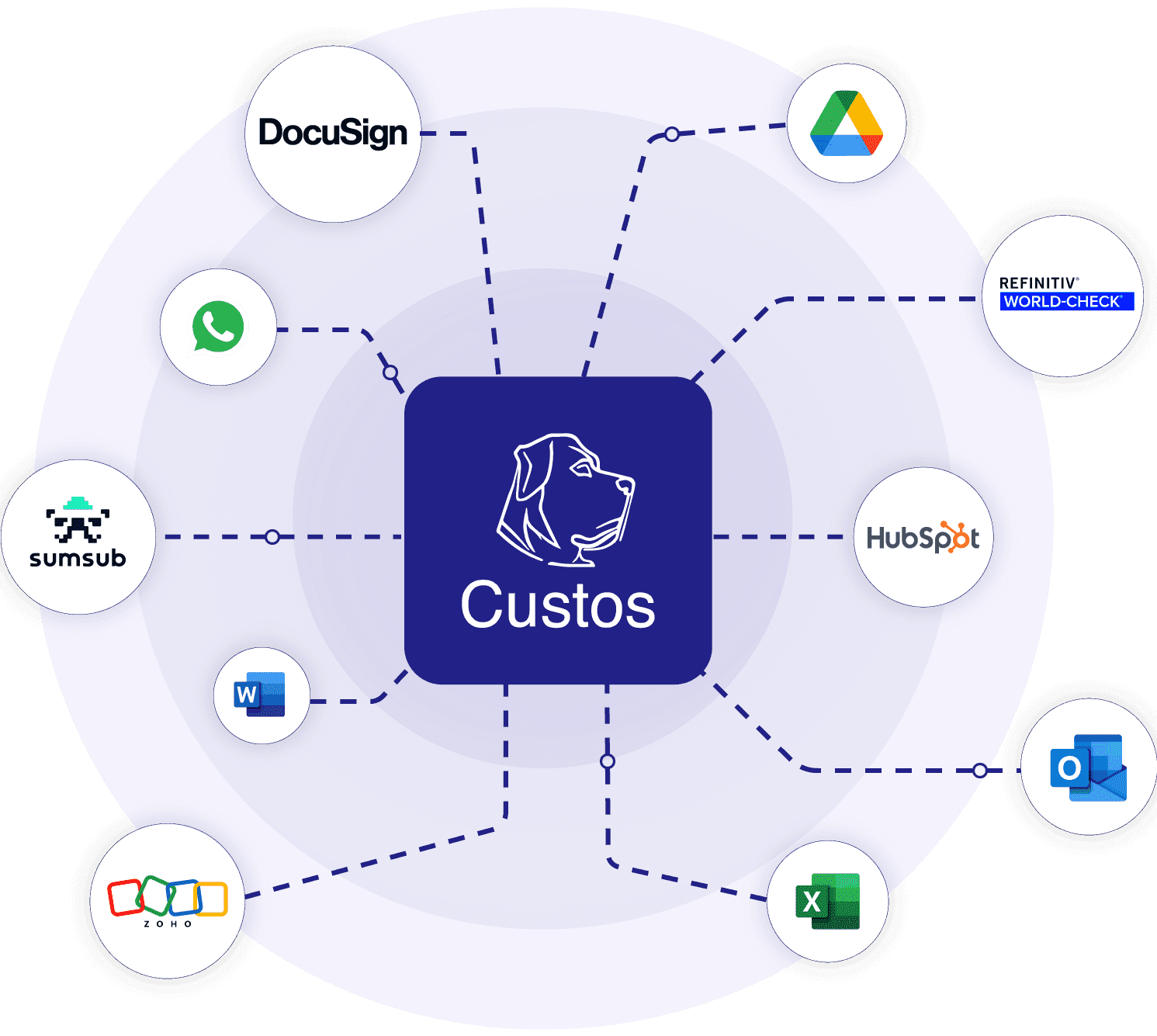

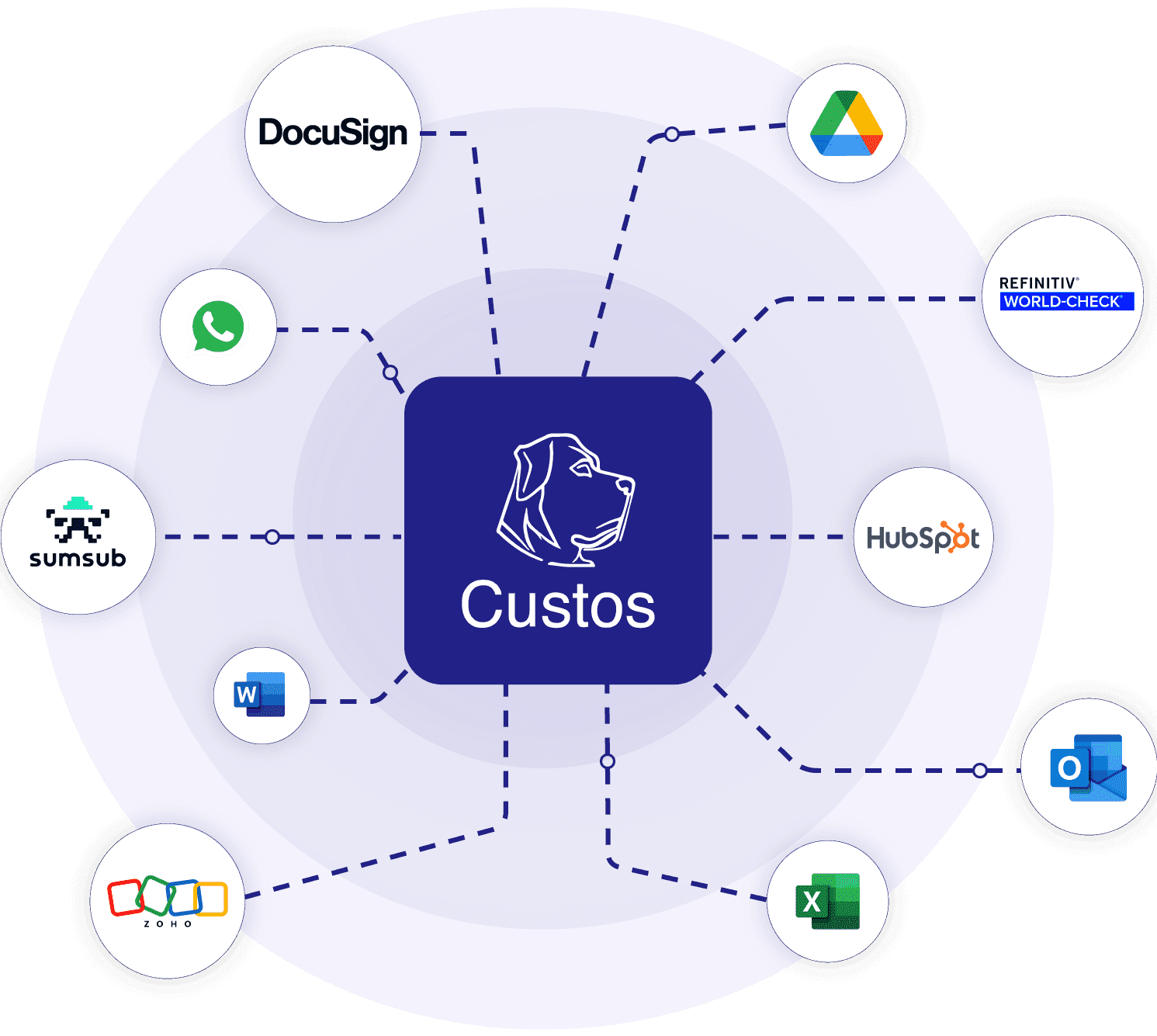

1. Centralized Workflow Management: Custos enables trust and corporate service providers to set up and manage all steps in a case — from screening and risk scoring to document collection — directly within the platform. This centralization removes the need for multiple tools, streamlining the entire process and reducing the risk of missed steps.

2. Automation of Key Compliance Functions: Custos’s platform integrates essential compliance tasks, such as document verification and identity checks, directly into case workflows. This level of automation enhances accuracy, reduces manual intervention, and speeds up case progression, allowing teams to focus on higher-value tasks.

3. Complete Case Visibility and Real-Time Updates: Custos provides full visibility into each case, showing users the status of every step, tracking comments or decisions, and offering real-time updates. This transparency is invaluable for cross-department collaboration, ensuring every team member stays informed and aligned on each case’s progress.

4. User-Friendly Experience Designed for trust and corporate service providers: Custos’s platform is built with user-friendliness in mind, making it accessible and easy to navigate for team members at all levels. It’s also designed for flexibility, allowing trust and corporate service providers to set up and structure cases to fit their unique workflows. Whether creating a simple client onboarding case or a complex compliance review, Custos makes it easy to customize steps, assign responsibilities, and define approval checkpoints. By centralizing all case management steps within a single system, Custos helps trust and corporate service providers handle cases efficiently, reduce compliance risks, and deliver a smoother client experience, with the adaptability to structure any workflow needed.

What is Case Management?

In the realm of trust and corporate service providers, case management refers to the structured handling of a series of interconnected tasks that may or may not require coordination across multiple teams. Case management is a critical method of bringing together people, processes, and documentation to ensure each step in a workflow is executed with accuracy and efficiency. Take, for example, the client onboarding process: this often involves various departments, such as client services, compliance, and finance, each contributing to specific steps that must be completed before onboarding is finalized.

Cases might start with document collection, proceed through identity verification, and include risk assessment, each stage involving different internal stakeholders. While case types vary based on organizational needs, they all share a common objective: ensuring a seamless, structured process that meets regulatory requirements and service standards. Because these processes are cross-departmental, trust and corporate service providers need a solid framework to keep every team aligned and prevent important tasks from slipping through the cracks.

The Role of Case Management for Trust and Corporate Service Providers

For trust and corporate service providers, case management is essential in several high-stakes areas where accuracy and auditability are paramount. Some of the most prominent examples include:

1. Client Onboarding and Entity Formation: Trust and corporate service providers are responsible for setting up new entities for clients, a process that involves stringent regulatory requirements and high standards for data accuracy. When forming an entity, trust and corporate service providers must verify the identities of all involved parties and ensure the characteristics of the entity aligns with jurisdictional requirements. This workflow involves multiple steps, from data collection to thorough verification, each one requiring input or approval from compliance or risk management teams. Case management becomes invaluable in tracking each task, maintaining records, and ensuring all requirements are met before moving forward.

2. Payment Processing and Monitoring: Once an entity is set up, trust and corporate service providers often process payments on behalf of clients, which introduces additional compliance needs. Payment processes are layered with various checks, particularly for large or high-risk transactions. For instance, a substantial transfer to a certain jurisdiction may trigger extra due diligence or security protocols. Effective case management helps trust and corporate service providers organize these multi-step checks, ensuring compliance requirements are met without excessive delay or risk of oversight.

3. Ongoing Monitoring and Compliance Checks: After onboarding, trust and corporate service providers must continually monitor client activities to detect any red flags or potential risks. This involves periodic reviews of client profiles, transaction patterns, and regulatory changes that may impact compliance. With case management, trust and corporate service providers can assign tasks, track progress, and ensure that each action is documented, creating an organized and reliable system for maintaining compliance over the long term. When a client’s profile is flagged, case management enables swift action by alerting relevant team members and allowing them to document and resolve issues efficiently.

The Patchwork of Tools: Challenges in Today’s Case Management

Many trust and corporate service providers still rely on an assortment of standalone tools to manage these complex workflows, creating a fragmented and often inefficient process. For example, one tool might handle client screening, another document uploads, and a third risk assessments, resulting in a disjointed user experience for both clients and teams. To help manage this patchwork of solutions, some organizations use task-tracking tools like Asana to manually monitor case progress, but such platforms lack compliance-specific capabilities and seamless integration across case management functions.

This fragmented approach not only slows down processes but also introduces risks, as critical steps can be missed, miscommunicated, or duplicated across systems. Furthermore, it’s challenging for team members to maintain a holistic view of each case when key details are scattered across different platforms. This siloed setup is inefficient and increases the risk of compliance lapses, which can be particularly costly or damaging in the trust and corporate service providers industry.

The Advantages of Integrated Case Management and Streamlined Workflows

Integrated case management platforms address these issues by bringing all necessary steps and stakeholders together within a single system. This centralization provides several important benefits for trust and corporate service providers:

1. Enhanced Visibility and Accountability: An integrated platform allows every team member to see the full scope of each case, including pending and completed tasks, responsibility assignments, and any outstanding requirements. This visibility not only keeps everyone on track but also ensures that any bottlenecks are quickly identified and resolved, helping cases progress efficiently.

2. Improved Cross-Departmental Collaboration: By having a unified platform, trust and corporate service providers can enable seamless teamwork across departments, as every team can access the same up-to-date information and easily communicate next steps or issues. This approach reduces time-consuming back-and-forths and fosters smooth collaboration, which is especially valuable for cases requiring multi-team involvement.

3. Time and Cost Savings: Integrated workflows eliminate the need for team members to constantly switch between platforms and hunt down information, allowing cases to move forward faster. This efficiency not only saves time but also reduces operational costs, as fewer resources are needed to manage each case.

4. Reduced Risk of Error: With all case details managed within a single platform, there’s a lower risk of oversight, duplication, or miscommunication. Every action can be tracked and documented in one place, ensuring all regulatory requirements are met and providing a reliable record for audits or investigations.

How Custos Excels in Case Management for trust and corporate service providers

Custos’s case management solution is purpose-built for trust and corporate service providers and other compliance-focused organizations, offering an intuitive platform where each step of a case can be managed from start to finish. With Custos, trust and corporate service providers can configure detailed workflows that cater to their unique process requirements, whether for onboarding new clients, processing payments, or conducting compliance reviews.

1. Centralized Workflow Management: Custos enables trust and corporate service providers to set up and manage all steps in a case — from screening and risk scoring to document collection — directly within the platform. This centralization removes the need for multiple tools, streamlining the entire process and reducing the risk of missed steps.

2. Automation of Key Compliance Functions: Custos’s platform integrates essential compliance tasks, such as document verification and identity checks, directly into case workflows. This level of automation enhances accuracy, reduces manual intervention, and speeds up case progression, allowing teams to focus on higher-value tasks.

3. Complete Case Visibility and Real-Time Updates: Custos provides full visibility into each case, showing users the status of every step, tracking comments or decisions, and offering real-time updates. This transparency is invaluable for cross-department collaboration, ensuring every team member stays informed and aligned on each case’s progress.

4. User-Friendly Experience Designed for trust and corporate service providers: Custos’s platform is built with user-friendliness in mind, making it accessible and easy to navigate for team members at all levels. It’s also designed for flexibility, allowing trust and corporate service providers to set up and structure cases to fit their unique workflows. Whether creating a simple client onboarding case or a complex compliance review, Custos makes it easy to customize steps, assign responsibilities, and define approval checkpoints. By centralizing all case management steps within a single system, Custos helps trust and corporate service providers handle cases efficiently, reduce compliance risks, and deliver a smoother client experience, with the adaptability to structure any workflow needed.

Blog

Blog

Blog